Results

Exempted Papers:

Starting Level: —

Papers Remaining: —

Cost Estimation

| Standard exam fee per paper | — |

| Exemption fee per paper | — |

| Total if no exemptions | — |

| Total with exemptions | — |

| Estimated Savings | — |

Documents you should prepare:

- Degree / provisional certificate

- Detailed transcripts (subject-wise)

- University accreditation proof (if applicable)

- Professional membership certificate (for CA/CMA/CS)

Planning to pursue ACCA in India? The ACCA exemption calculator can be your gateway to saving time, money, and effort on your journey to becoming a globally recognized chartered accountant.

With the right exemptions, you can skip up to 9 ACCA exams and jump directly to advanced levels of the qualification.

Understanding ACCA and the Power of Exemptions

The Association of Chartered Certified Accountants (ACCA) is a globally recognized professional qualification that opens doors to lucrative career opportunities worldwide.

What makes ACCA particularly attractive for Indian students is its flexible exemption system.

ACCA exemptions allow you to skip certain papers based on your prior academic achievements or professional qualifications.

These exemptions ensure you start the qualification at the most appropriate level, avoiding repetition of subjects you’ve already mastered.

Key benefits of ACCA exemptions include:

- Reduced study time and faster qualification completion

- Lower overall costs by eliminating unnecessary exam fees

- Focused preparation on advanced subjects

- Earlier entry into the job market

How the ACCA Exemption Calculator Works

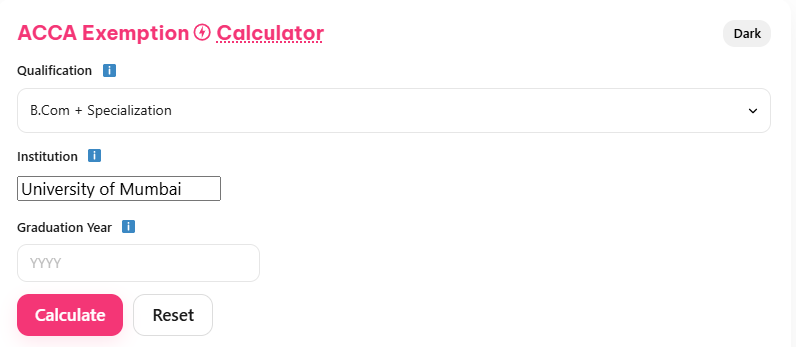

The ACCA exemption calculator is a powerful tool that analyzes your educational background to determine which exams you can skip. The process involves:

Step-by-Step Process:

- Select Your Institution: Choose your university or educational institution from the comprehensive database

- Enter Course Details: Specify your degree, specialization, and graduation year

- Review Results: Receive a detailed breakdown of your eligible exemptions

- Plan Your Journey: Use the results to create an optimized study timeline

The calculator considers various factors including:

- Your highest educational qualification

- Institution accreditation status

- Course curriculum alignment with ACCA syllabus

- Year of graduation (some exemptions have time limits)

ACCA Exemption Eligibility for Indian Qualifications

Understanding exemption eligibility is crucial for Indian students. Here’s a comprehensive breakdown:

High School Graduates (Grade 10/12)

- Exemptions: None

- Starting Point: Knowledge Level (Applied Knowledge exams)

- Total Papers: 13 exams required

B.Com and Specializations (Pursuing/Completed)

Indian students pursuing or having completed B.Com degrees from recognized universities can receive significant advantages:

- Potential Exemptions: Up to 5 papers

- Exempted Papers: Typically BT, MA, FA, LW, and TX

- Starting Point: Skills Level

- Remaining Papers: 8 exams

- Special Note: Students currently pursuing B.Com may receive conditional exemptions

| Qualification | Exemptions | Starting Level | Papers Remaining |

| B.Com (General) | 3-5 | Skills Level | 8-10 |

| B.Com (Hons) | 4-5 | Skills Level | 8-9 |

| B.Com + Specialization | 5 | Skills Level | 8 |

CA Inter/IPCC + B.Com

This combination is particularly powerful for Indian students:

- Exemptions: 6+ papers

- Starting Point: Skills Level

- Benefits: Strong accounting foundation accelerates learning

Chartered Accountants (Qualified)

Indian CAs receive maximum benefits:

- Exemptions: Up to 9 papers

- Starting Point: Strategic Professional Level

- Advantage: Direct entry to advanced level

MBA Finance and Specialized Degrees

- MBA Finance: Exemptions typically include PM and FM papers

- M.Com: Similar to B.Com but potentially more exemptions

- Other Specialized Degrees: Exemptions vary based on curriculum alignment

Additional Indian Qualifications Worth Mentioning:

- Cost and Management Accountancy (CMA India): Specific exemptions based on completion level

- Company Secretary (CS): Potential exemptions in Corporate and Business Law

- Banking and Finance Diplomas: May qualify for specific paper exemptions

- Professional Certifications: Various industry certifications may contribute to exemptions

ACCA Exemption Fees and Financial Planning

Understanding the cost structure is essential for effective financial planning:

Fee Structure:

- Per Exemption Fee: Each exemption carries a separate fee

- Payment Timeline: Fees must be paid within 30 days of exemption award

- Refund Policy: Refunds available if cancelled within 14 days

Cost-Saving Strategies:

- Compare Total Costs: Sometimes taking the exam might be more economical than claiming exemptions

- Bulk Applications: Apply for all eligible exemptions simultaneously

- ALP Discounts: Many Approved Learning Partners offer exemption fee discounts

- Timing Considerations: Plan exemption claims strategically with your study schedule

Sample Cost Analysis:

| Scenario | Exam Fees | Exemption Fees | Total Savings |

| No Exemptions | $2,600 (13 papers) | $0 | $0 |

| 5 Exemptions | $1,600 (8 papers) | $800 | $200 |

| 9 Exemptions | $800 (4 papers) | $1,440 | $360 |

Note: Actual fees vary and should be verified on the official ACCA website

Maximizing Your ACCA Journey: Strategic Considerations

Should You Claim All Available Exemptions?

While exemptions offer obvious benefits, consider these factors:

Advantages of Claiming Exemptions:

- Faster completion time

- Reduced study burden

- Lower overall exam stress

- Quicker entry to job market

When to Consider Taking Exams Instead:

- If your prior qualification was completed several years ago

- When you want to refresh fundamental concepts

- If exemption fees exceed exam fees significantly

- To build confidence before tackling advanced papers

Knowledge Retention vs. Speed

The decision between claiming exemptions and taking exams should consider:

- Recent Graduates: Generally benefit from claiming exemptions

- Working Professionals: May prefer refreshing knowledge through exams

- Career Changers: Often need foundational knowledge reinforcement

Practical Application Guide

Required Documentation for Indian Students:

- Original Degree Certificates: Both provisional and final certificates

- Detailed Transcripts: Subject-wise marks and syllabus details

- University Recognition: Proof of university accreditation

- English Translations: For certificates in regional languages

- Professional Membership Certificates: For CA, CMA, or other qualifications

Step-by-Step Application Process:

- Use the Calculator: Determine your eligible exemptions

- Gather Documents: Collect all required certificates and transcripts

- Submit Application: Through the official ACCA portal

- Pay Fees: Complete payment within stipulated timeframe

- Await Confirmation: ACCA will review and confirm exemptions

Integration with Oxford Brookes BSc Degree

Many Indian students pursue the Oxford Brookes BSc in Applied Accounting alongside ACCA:

Key Considerations:

- Exemption Limitations: Some exemptions cannot be used for the BSc degree

- Mandatory Papers: FR, AA, and FM must be completed through exams

- Time Restrictions: Exemptions older than 10 years are not accepted

- Strategic Planning: Balance ACCA exemptions with BSc requirements

Recommended Approach:

- Plan exemptions considering both ACCA and BSc requirements

- Prioritize papers that benefit both qualifications

- Consult with advisors before finalizing exemption strategy

Success Stories and Real-World Examples

Case Study 1: B.Com Graduate

Background: Mumbai University B.Com graduate with 5 exemptions

Strategy: Claimed all exemptions, focused on Skills Level papers

Outcome: Completed ACCA in 18 months, secured Big 4 position

Key Learning: Exemptions enabled intensive focus on complex subjects

Case Study 2: CA Inter + B.Com

Background: Delhi student with CA Inter completion

Strategy: Strategic mix of exemptions and exam preparation

Outcome: Strong foundation led to consistent high scores

Key Learning: Balanced approach maximized both speed and knowledge

Case Study 3: Working Professional MBA

Background: Finance professional with MBA and 5+ years experience

Strategy: Claimed relevant exemptions, focused on strategic papers

Outcome: Career advancement to CFO role within 2 years

Key Learning: Exemptions allowed focus on leadership-oriented subjects

Common Mistakes to Avoid

Documentation Errors:

- Incomplete transcript submissions

- Missing university accreditation proof

- Outdated certificates beyond validity periods

- Incorrect translation procedures

Strategic Missteps:

- Claiming exemptions without considering knowledge gaps

- Ignoring fee implications in overall cost planning

- Not aligning exemptions with career objectives

- Rushing decisions without proper evaluation

Timeline Management:

- Missing payment deadlines for exemptions

- Poor coordination between exemption claims and exam scheduling

- Inadequate planning for document processing time

Expert Recommendations for Indian Students

Academic Background Optimization:

- For Current Students: Ensure your university appears in the ACCA exemption database

- For Graduates: Keep all academic documents readily available

- For Professionals: Document continuing education and professional development

Financial Planning Tips:

- Budget for exemption fees in overall ACCA cost calculations

- Compare costs between exemptions and exam fees

- Investigate ALP partnerships for potential discounts

- Plan for additional costs like documentation and translation

Study Strategy Enhancement:

- Use exemptions to accelerate initial progress

- Focus saved time on mastering advanced concepts

- Maintain balance between speed and knowledge depth

- Regular assessment of learning gaps through practice tests

Your Next Steps to ACCA Success

Start Your ACCA Journey with Exemptions – Calculate your eligible exemptions now and fast-track your path to becoming a globally recognized accounting professional.