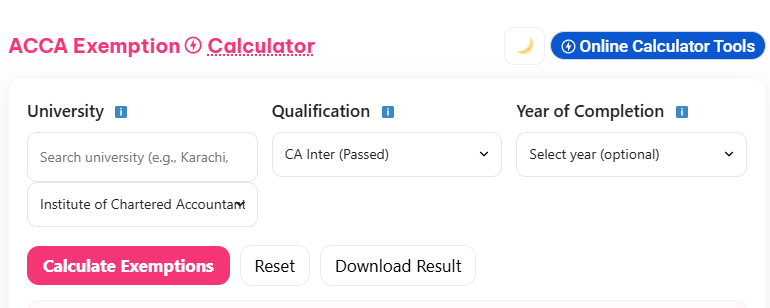

ACCA Exemption Calculator

Result Summary

University:

Qualification:

Starting Level:

Exempted Papers (0):

Remaining Papers (0):

Estimated Exemption Fee per Paper: PKR 18,000

Total Estimated Exemption Fee: PKR 0

Are you a Pakistani student or professional considering the ACCA qualification? Understanding ACCA exemptions can significantly fast-track your journey and save you both time and money.

With the right qualifications, you could potentially skip up to 9 out of 13 ACCA papers, allowing you to focus on advanced topics and accelerate your career in finance and accounting.

What are ACCA Exemptions?

ACCA exemptions are credits granted to students who have completed relevant qualifications before enrolling in the ACCA program.

These exemptions recognize your prior learning and allow you to skip certain exams where your previous education already covers the required knowledge and skills.

Rather than forcing you to repeat subjects you’ve already mastered, ACCA’s exemption system ensures you start your qualification journey at the most appropriate level.

This approach respects the time and effort you’ve already invested in your education while making your path to ACCA membership more efficient.

Benefits of Claiming Exemptions

Understanding the advantages of ACCA exemptions can help you make informed decisions about your qualification strategy:

Time Efficiency

Exemptions can reduce your ACCA journey from 13 papers to as few as 4 papers, depending on your qualifications. This means you could complete your ACCA qualification significantly faster.

Cost Savings

Fewer exams mean lower exam fees, reduced study material costs, and less time away from earning potential. The financial benefits compound over time.

Focused Learning

With exemptions handling your foundational knowledge, you can concentrate your efforts on advanced topics that will have the greatest impact on your career.

Career Acceleration

Faster qualification completion means earlier access to ACCA membership benefits and enhanced career opportunities in Pakistan’s growing finance sector.

A Step-by-Step Calculation Guide

Our ACCA exemption calculator is designed specifically for Pakistani students and professionals, taking into account local qualifications and educational standards.

How to Use Our ACCA Exemption Calculator

Step 1: Select Your Country

Choose Pakistan from the dropdown menu to ensure the calculator uses the correct criteria for Pakistani qualifications.

Step 2: Input Your Qualifications

Enter details about your educational background, including:

- University name

- Degree type and specialization

- Year of completion

- Any professional qualifications

Step 3: Review Your Results

The calculator will display:

- Which ACCA papers you can skip

- Which papers you still need to complete

- Your recommended starting level

Eligibility Criteria for ACCA Exemptions

Different Pakistani qualifications offer varying levels of exemptions:

| Qualification | Potential Exemptions | Starting Level |

| B.Com (Bachelor of Commerce) | Up to 5 papers | Skills Level |

| CA Inter/IPCC | 6+ papers | Skills Level |

| MBA in Finance | 3-5 papers | Skills or Knowledge Level |

| PIPFA Membership | Varies by experience | Skills Level |

Detailed Exemption Examples

B.Com (Bachelor of Commerce): Graduates from recognized Pakistani universities may be eligible for exemptions from:

- Business and Technology (BT)

- Management Accounting (MA)

- Financial Accounting (FA)

- Corporate and Business Law (LW)

- Taxation (TX)

CA Inter/IPCC (Chartered Accountancy Intermediate): Students who have cleared CA Inter can typically claim exemptions for:

- All Applied Knowledge papers (BT, MA, FA)

- Selected Applied Skills papers (LW, TX, AA)

- Additional papers based on specific subject performance

MBA in Finance: Depending on course content and university accreditation, candidates might receive exemptions in:

- Financial Management (FM)

- Performance Management (PM)

- Business and Technology (BT)

PIPFA (Pakistan Institute of Public Finance Accountants): Members may receive exemptions based on their qualification level and relevant work experience in public finance.

Documents Required

To claim your ACCA exemptions in Pakistan, you’ll need to prepare the following documentation:

Academic Documents

- Original degree certificates (B.Com, MBA, etc.)

- Official transcripts showing subjects studied and grades achieved

- University verification letters confirming degree authenticity

Professional Qualification Documents

- Professional membership certificates (CA, PIPFA, etc.)

- Exam result confirmations for partially completed qualifications

- CPD records for professional development activities

Supporting Documentation

- Passport or CNIC copy for identity verification

- English translations of any documents not in English (certified translations required)

- Employer verification letters for work experience claims (if applicable)

Important Notes on Documentation

- All documents must be clear, legible copies

- Original documents may be required for verification

- Certified translations must be provided for non-English documents

- Documents should be less than 10 years old for optimal consideration

Maximizing Your ACCA Journey with Exemptions

Strategic Planning

Before claiming exemptions, consider your long-term career goals. While exemptions save time, ensure you’re not creating knowledge gaps that might affect your professional competence.

Conditional Exemptions

Some exemptions are conditional, meaning they depend on completing your current qualification successfully.

Make sure you understand these conditions before planning your ACCA timeline.

Fee Considerations

Each exemption comes with a fee (approximately PKR 15,000-20,000 per paper).

Calculate the total cost against potential time savings to determine if exemptions are financially beneficial for your situation.

Knowledge Assessment

Use ACCA’s Get Ready Modules to test your understanding of exempted topics. If you identify significant knowledge gaps, consider taking the exam instead of claiming the exemption.

Frequently Asked Questions

What is the ACCA exemption fee, and is it refundable?

ACCA charges approximately PKR 15,000-20,000 per exemption, depending on the paper level.

Exemption fees are generally non-refundable unless you cancel within 14 days of award notification.

How do I apply for ACCA exemptions in Pakistan?

You can apply through your MyACCA account online, by submitting documents to ACCA directly, or through an ACCA Approved Learning Partner in Pakistan.

Can I claim exemptions based on work experience?

ACCA does not typically grant exemptions based solely on work experience for the main qualification.

However, extensive relevant experience may be considered alongside formal qualifications.

How long does the exemption application process take?

The process typically takes 4 to 6 weeks from document submission to final decision, depending on the complexity of your qualifications and current application volumes.

What qualifications from Pakistan are eligible for ACCA exemptions?

Recognized qualifications include B.Com from HEC-approved universities, CA Inter/Final, PIPFA qualifications, and MBA degrees from accredited institutions.

Can I cancel my exemptions if I change my mind?

Yes, you can cancel exemptions within 14 days of award notification for a full refund. After this period, exemption fees are non-refundable.

Are there any deadlines for claiming exemptions?

You can claim exemptions at any time after registration, but it’s advisable to do so early to plan your study schedule effectively.

Do I need to provide translated documents?

Yes, all documents not in English must be accompanied by certified translations from approved translation services.

Your Path to ACCA Success Starts Here

Ready to discover your exemption potential? Use our ACCA exemption calculator today and take the first step toward your ACCA qualification.

Whether you’re a recent graduate or an experienced professional, there’s never been a better time to invest in your accounting and finance career.